[ad_1]

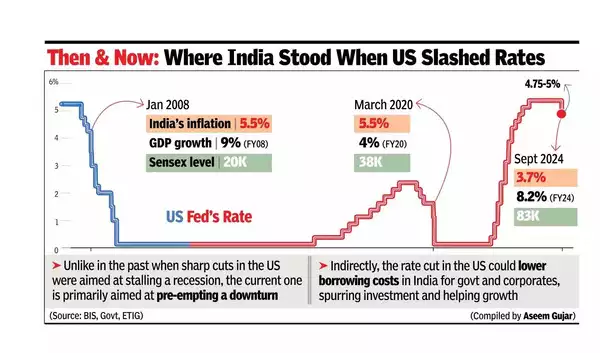

It could help increase the flow of foreign funds into Indian markets, aid the rupee’s stability and fuel the current bull rally, top govt officials, economists and fund managers said. Indirectly, this could lower borrowing costs for govt and corporates, spurring investment and helping growth.

Unlike in the past when sharp 50bps rate cuts in the US were aimed at stalling a recession in the world’s largest economy, the current one is primarily aimed at pre-empting a downturn, economists said.

On Thursday, the 50-basis-point (100bps = 1 percentage point) US rate cut decision propelled the sensex to a new peak even as it closed marginally higher at 83,185 points, the rupee gained 10 paise against the dollar to 83.66 while the 10-year yield closed barely changed at 6.76%.

A top finance ministry official said that the Fed move will not have a significant impact on capital flows, while it’s positive for the Indian economy overall. “It is positive for the global economy, including the Indian economy,” Ajay Seth, economic affairs secretary at the finance ministry, told reporters in Delhi. “I don’t see that (50bps cut) making any significant impact on inflows. We have to see from (the point of) where the (US interest rates) levels are. We have to see how other economies’ (and) markets behave,” Seth said.

Echoing Seth’s views chief economic adviser, V Ananatha Nageswaran said that the impact of Fed decision on India will be “little muted” and much of the rate cut decision is already priced in.

Economists feel that Fed’s decision is unlikely to prompt a similar move by RBI and a rate cut in India could come in only early next year. “The aggressive rate cut by the Fed has an important bearing on RBI’s own decision on interest rates. Although this is not explicit, fall in dollar rates impact domestic inflation through international prices,” said Soumya Kanti Ghosh, group chief economic adviser, SBI.

“Additionally, the better liquidity position may provide the cushion to (RBI) to let the festive season tide over. As such, we don’t anticipate any rate action by RBI in 2024. An early 2025 rate cut (Feb) looks the best bet,” Ghosh added.

From the stock market’s side, “this rate cut (by the Fed) will facilitate flows to the emerging market assets with weaker dollar and lower rates”, said Nilesh Shah, MD, Kotak Mahindra MF.

In the domestic market on Thursday, the Fed’s decision had boosted investor sentiment that pushed the sensex up by nearly 850 points in early trades to 83,774. From there profit taking pulled it down and the index closed at 83,185 points, up 237 points or 0.3%. Outside of the blue chips, however, there was strong selling. As a result, BSE’s midcap index closed 0.5% lower while the smallcap index closed 1.1% down.

[ad_2]

Source link