[ad_1]

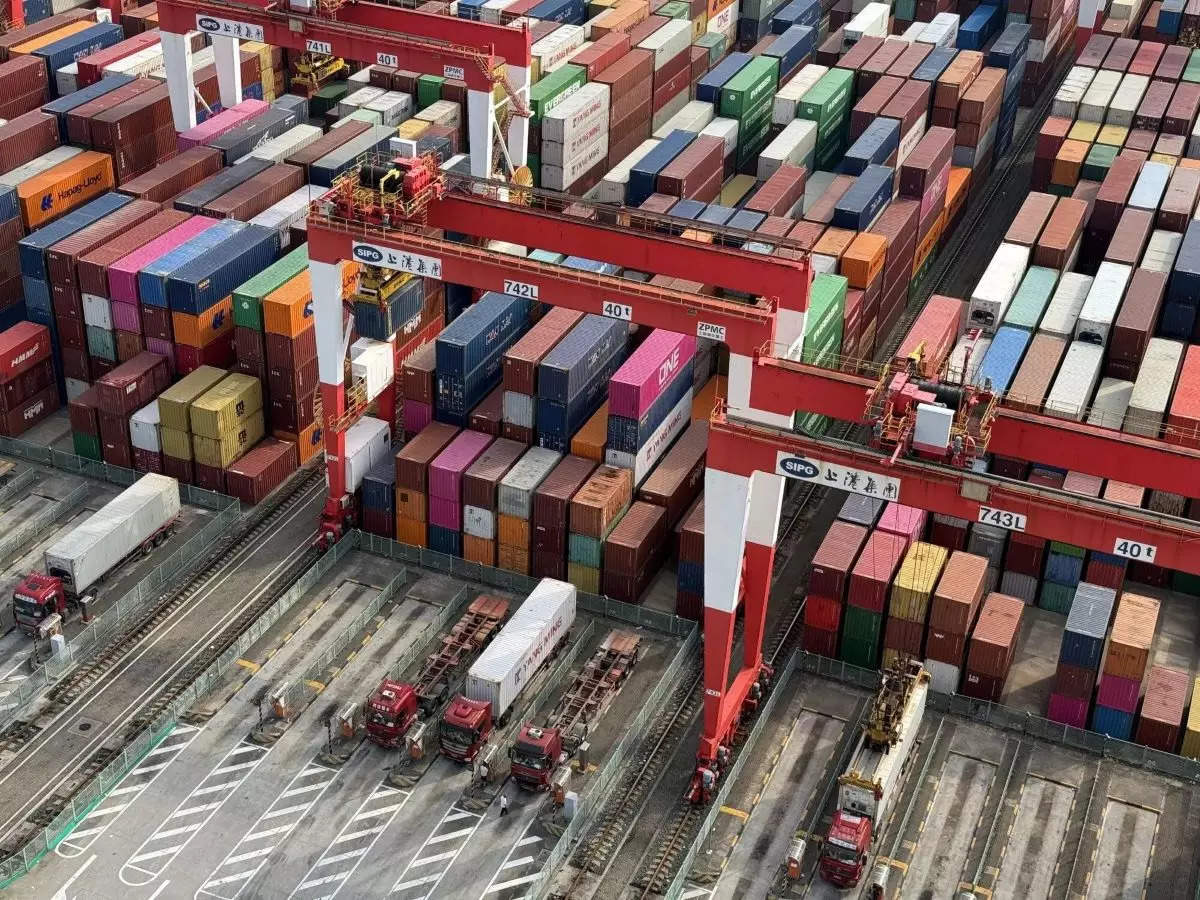

One of the key elements of Trump’s election manifesto was a universal tariff on imports from all countries. Imports from China would, however, face a 60% tariff. Such duties are aimed at discouraging imports and boosting domestic production in the US.

“A Trump administration is likely to bring renewed trade tensions, with potential adverse effects on India’s key export sectors and capital inflows,” said Nitin Aggarwal director–investment research and advisory at Client Associates. “The economic outlook for India will depend significantly on the global trade environment and how quickly the US economy adjusts to the policy changes that are likely to follow a Trump victory.”

Market participants have contrasting views on which sectors would be impacted by the shifting political dynamics in the US. Aggarwal expects pharmaceuticals and IT to face challenges. The optimism about the domestic exporters’ prospects stems from the view that China would face higher tariffs than India.

“We can see aggressive implementation of tariffs for goods Imported into the US. Indirectly, the maximum impacted would be China,” Vaibhav Sanghavi, chief executive officer at ASK Hedge Solutions. “In the recent past, we have seen a surge of interest towards China, post stimulus. This may reverse back to other emerging markets, should it be implemented.” Some see sectors like electronics manufacturing services (EMS) and chemicals benefitting from Trump becoming the President.

“While global trade volatility may rise, India stands to benefit as a relative beneficiary amongst emerging markets as US companies pursue a ‘China +1’ strategy, likely boosting sectors like EMS, chemicals, and pharma,” said Trideep Bhattacharya, CIO-equities, Edelweiss Mutual Funds.

[ad_2]

Source link