[ad_1]

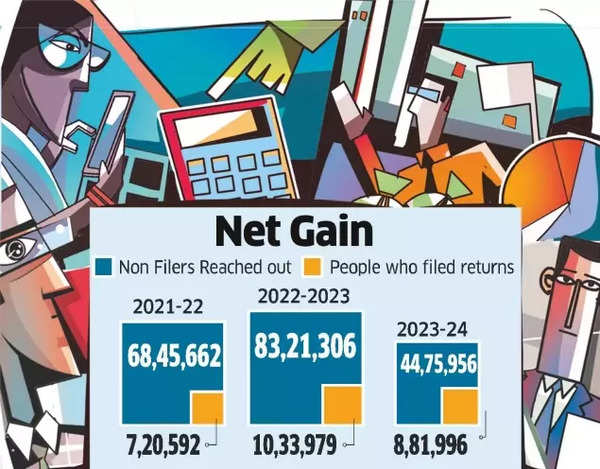

Income Tax Department’s extensive crackdown! Over the past 20 months, the Income Tax Department has collected Rs 37,000 crore from individuals who had taxable income but failed to file returns, according to officials.

Officials analysed data on substantial transactions since 2019-20, including purchases of gems, jewellery, property and luxury holidays paid in cash. “These are the cases where people were not filing tax returns despite making large purchases. The department had reached out to them over the past 20 months,” a senior official informed ET.

The official noted that an expanded and stricter tax collection and TDS system has helped identify significant transactions that previously went unnoticed.

The official indicated that some individuals submitted returns claiming zero income despite substantial expenditure and tax obligations. From the total Rs 37,000 crore recovered, Rs 1,320 crore came from individuals involved in high-value transactions.

Income Tax Department Crackdown

The department is conducting an extensive initiative to contact taxpayers whose spending patterns do not align with their declared income.

Since FY21, it has actively used data analytics and the Non-Filer Monitoring System to identify non-compliant individuals.

“Data from multiple sources is being tapped and synchronised… This makes it easy for the department to identify such evasion and nab evaders,” the official stated.

Official data revealed that direct tax collections for April-November increased by 15.4% to Rs 12.10 lakh crore, comprising Rs 5.10 lakh crore in corporate tax and Rs 6.61 lakh crore in non-corporate tax.

[ad_2]

Source link