[ad_1]

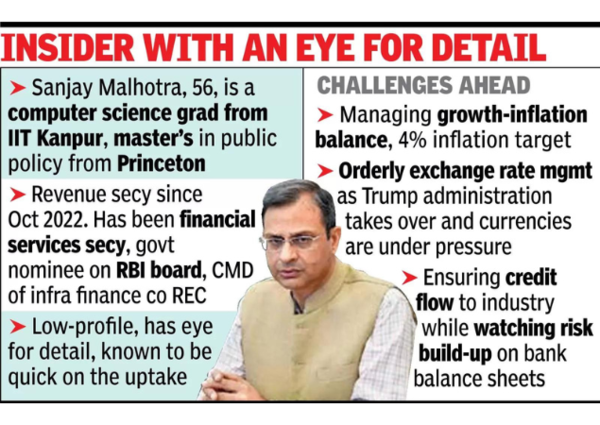

NEW DELHI: Government on Monday sprung a surprise by naming revenue secretary Sanjay Malhotra, 56, as the 26th Reserve Bank of India governor to replace Shaktikanta Das, whose six-year stint on Mumbai’s Mint Road ends on Tuesday.

After weeks of suspense, the appointments committee of cabinet zeroed in on Malhotra hours before Das’s tenure was to end. Like his predecessors, Malhotra has been given a 3-year term starting Dec 11.

The appointment was a surprise for Malhotra himself and he was said to be coming to grips with the development as he left North Block on Monday evening.

IAS topper from 1990 batch, Malhotra – who has been poring over Budget proposals and preparing for the crucial GST Council meeting later this month – will leave IAS more than three years before his age of retirement to take up one of the most powerful jobs in the country.

Malhotra is a computer science graduate from IIT Kanpur and has a master’s from Princeton University.

Hailing from Bikaner, Malhotra will be the third IITian, after Raghuram Rajan (IIT Delhi) and D Subbarao (IIT Kharagpur) to occupy the crucial 18th floor office in RBI, and also the second Malhotra – after R N Malhotra (1985 to 1990) – to lead the regulatory agency.

But the similarities end there. In opting for Malhotra, the Modi govt has signalled its preference for a civil servant to run Reserve Bank after Das, also from IAS, ensured smooth coordination with Centre, ending years of tussle between the finance ministry and the central bank over multiple issues – from the trajectory of interest rates to managing govt borrowings, the formula for paying dividends and recognising bad debts of banks.

While Malhotra has been dealing with Centre’s revenues ever since he moved to North Block in Oct 2022, he is no stranger to financial services. Between Feb and Oct 2022, he was secretary in the department of financial services, overseeing state-owned banks and insurance companies.

.During this period, he was also the government’s nominee on RBI’s central board. Before that, he spent two years as the chairman and managing director of REC, the state-run infrastructure finance company. Malhotra came into his own when he shifted to the revenue department.

The low-profile bureaucrat has an eye for detail, which officials said was visible during the pre-Budget meetings when he would take up issues related to tax returns with the direct and indirect tax brass. “He knows the details himself, so it is difficult to bluff him. Although he is soft-spoken, he can be assertive,” said an officer, who has attended several of his meetings.

Another officer said that he would even bring up latest court rulings during his meetings with revenue officials, asking them to factor those in. “He has a good sense of how the economy will respond to a certain proposals and quickly understands the requirements of the job,” the official said, adding that the way Malhotra led the entire Financial Action Task Force (FATF) review also worked in his favour as India came out as one of the top performers.

Always smartly turned out, Malhotra invariably engages attention with his colourful ties that are well coordinated with his suits, He enjoys the trust of finance minister Nirmala Sitharaman who often turns to him for technical input in complicated tax matters.

Whether it was dealing with tax deduction on virtual digital assets or the revamped capital gains regime, the Rajasthan-cadre officer was willing to tackle issues even when public opinion did not favour the proposals. He was equally at ease dealing with GST issues: a vexed subject requiring striking a fine balance with the competing demands of states.

[ad_2]

Source link